2. The Language of Focused 15 Investing (TRANSCRIPT BELOW)

Focused 15 Investing is an unusual investment approach. We have developed language to describe its key elements and to describe a market's current resilience. This section covers the following points:

- A detailed discussion of the MRI

- The MRI are additive/reinforce each other in same direction, negate when in opposing

- MRI rating scheme and what that means

3 minutes

Focused 15 Investing is an unusual investment approach and has specific terminology.

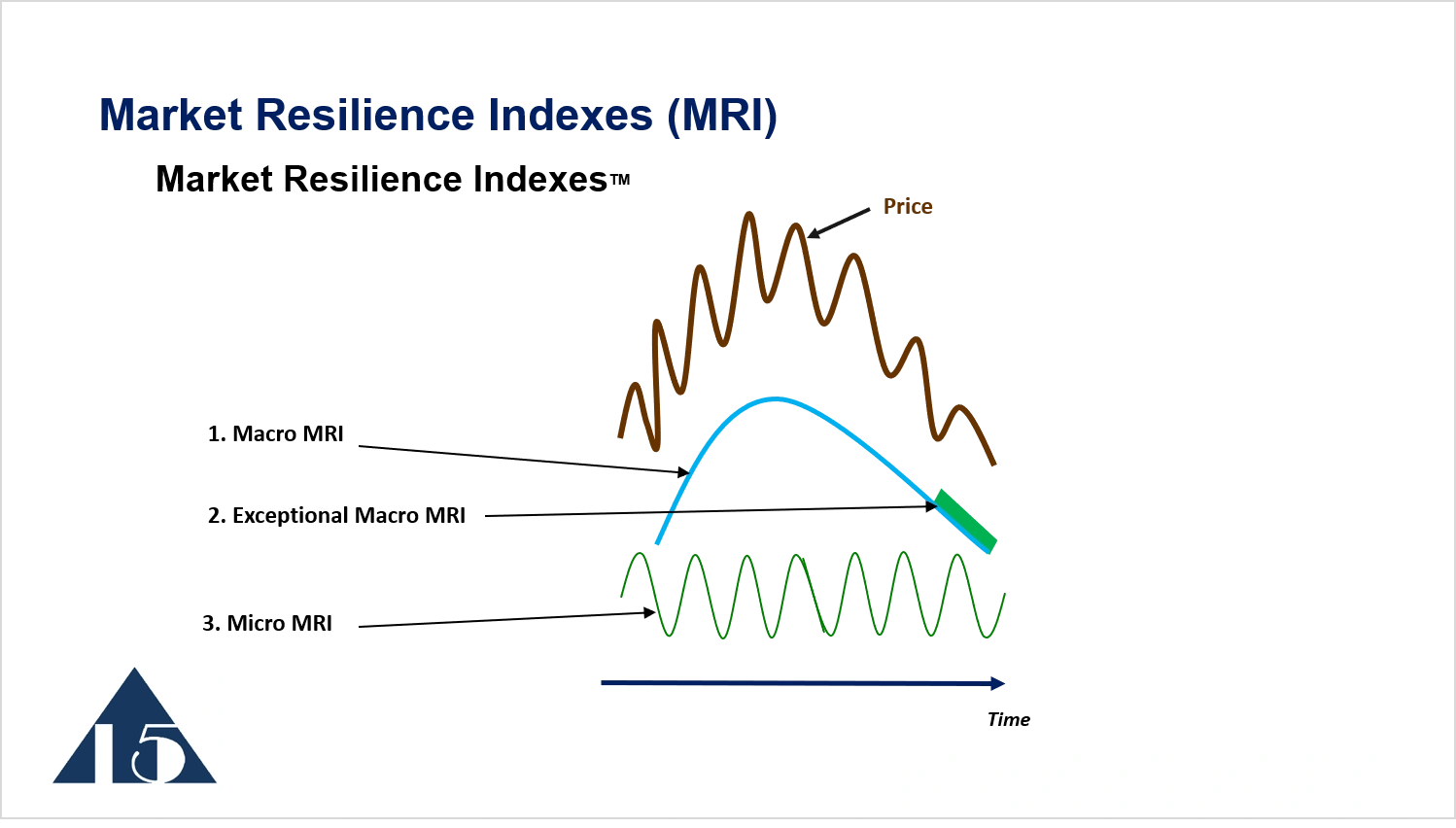

We typically discuss three main market resilience indexes (MRI):

- Macro MRI - measuring the longer-term trends that last several years. A positive slope indicates resilience and supports higher prices longer term. A negative slope indicates vulnerability and lower prices longer-term.

- Exceptional Macro MRI - indicates (on its appearance) when the Macro MRI may develop a steeper positive slope, or (on its disappearance) a less steep slope

- Micro MRI - shows the bursts of resilience that take place a few times a year

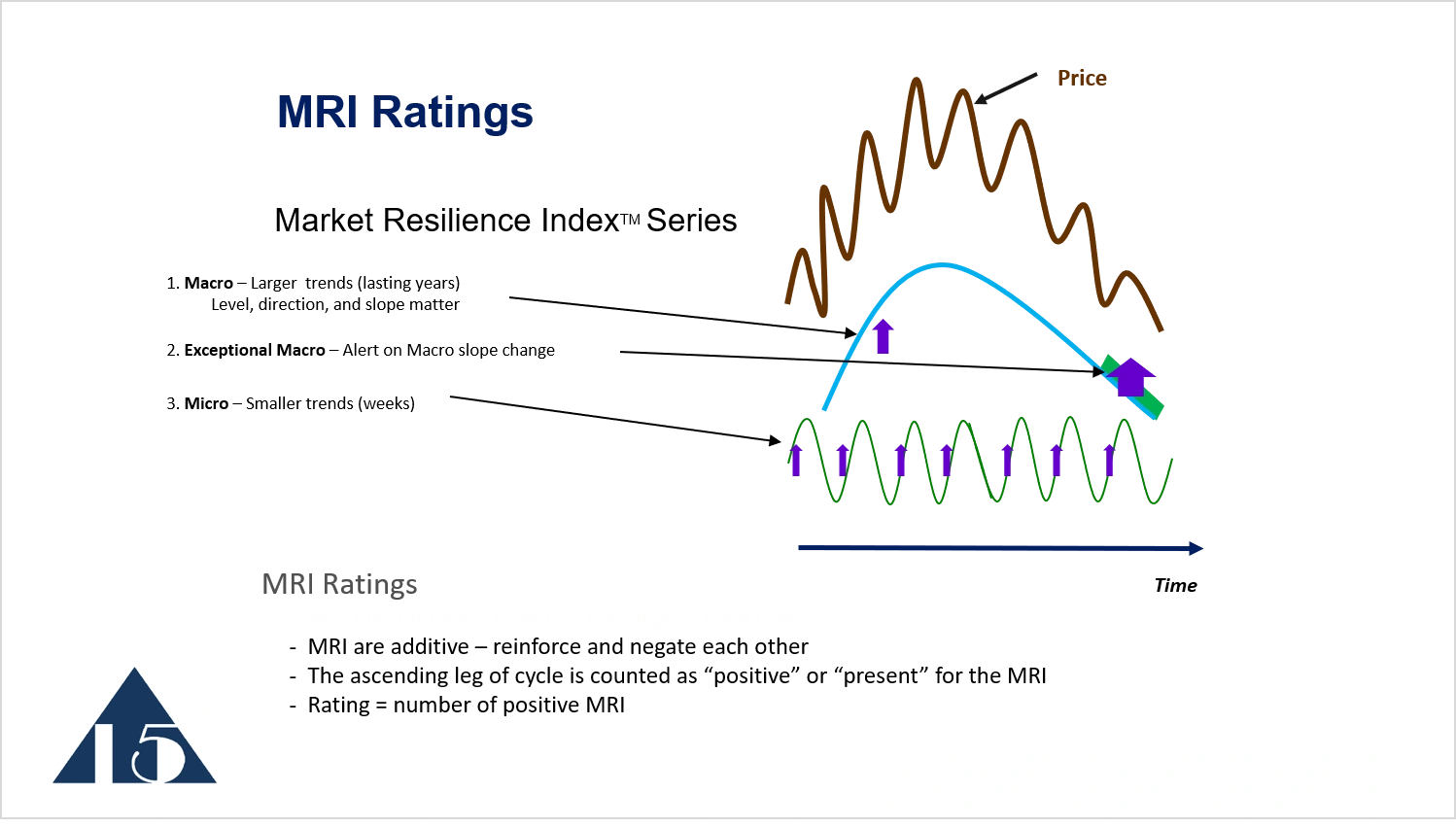

The MRI ratings are based on a few ideas. The MRI are additive: they reinforce each other when they're moving in the same direction, and they negate each other when they're moving in opposing directions.

The ascending leg of the cycle creates resilience. Resilience is counted and described as being positive or present during the uplegs. For example, when the Macro MRI is trending positive, we say that it is present or positive. When the Exceptional Macro MRI occurs, it is positive and provides resilience.

The up-legs of the Micro MRI are described as providing resilience. Thus, we have measures of very long-term resilience in the Macro MRI; the Exceptional Macro MRI, which foreshadows a trough in the Macro MRI; and the bursts of resilience in the Micro MRI.

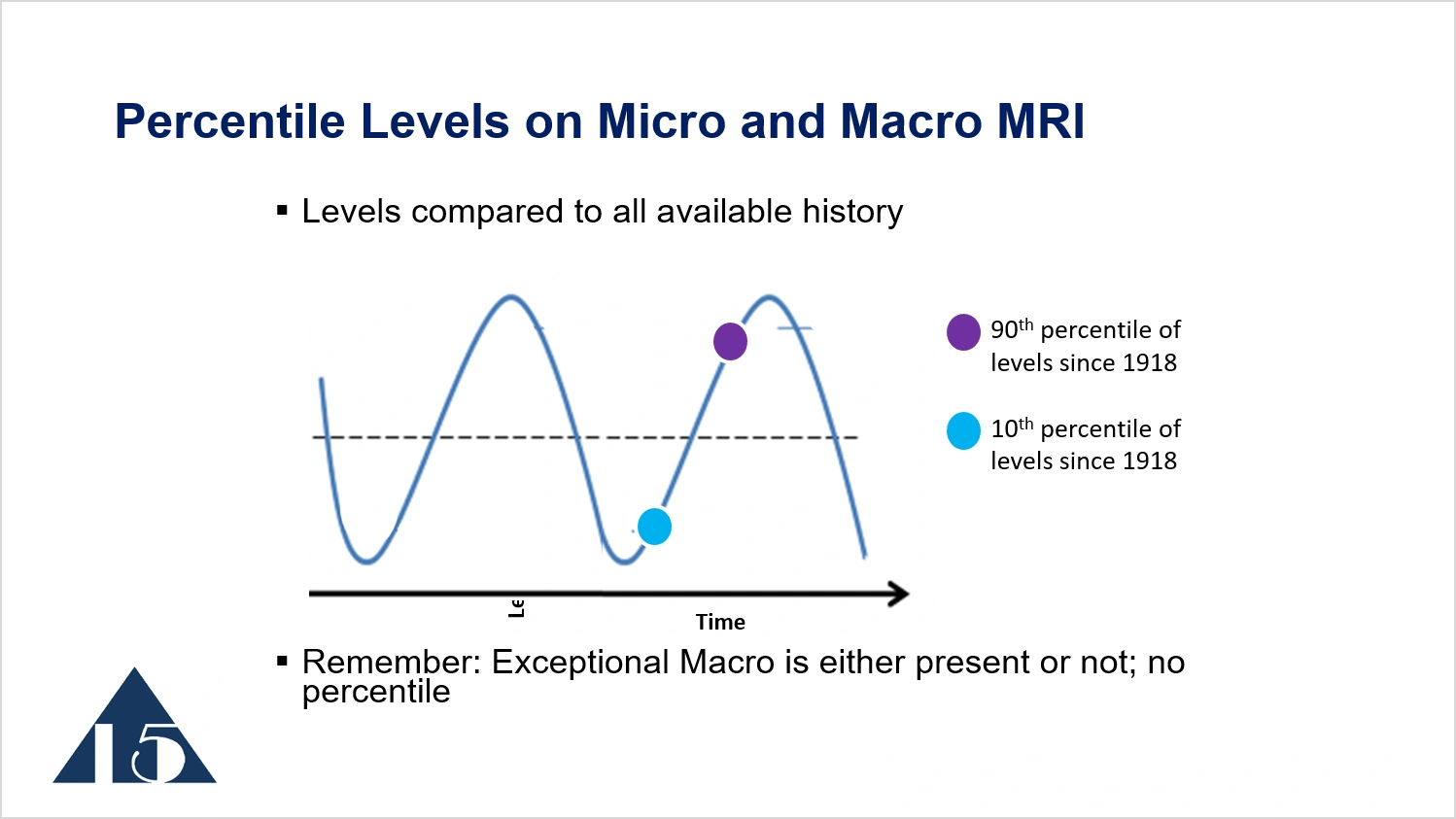

To describe the levels of the Micro and Macro MRI, we use the percentile levels. Picture these cyclical patterns going back one hundred years for the Dow Jones Industrial Average, there are cycles that move up and down. If we indicate that the current level is at the 90th percentile, you'll have an idea that it's very close to the top of its normal range that has been established over the 100-year period.

If a stock index is at the 10th percentile of the historical Micro MRI cycle and on the upleg of the cycle, we can expect that the stock index will likely experience resilience from the Micro MRI for several weeks as it continues to move higher through the upleg.

If a stock index is at the 90th percentile of historical levels and still in the upleg of the cycle, we can assume that there will be a peak in the Micro MRI in a week or two.

These three Market Resilience Indexes provide weekly indicators of the current market resilience. When all three are providing resilience, we describe the resilience rating as a "3," which is the most resilient. A rating of "0" means that none are in the uplegs of their cycles and we describe the market as least resilient or most vulnerable.

When the market is resilient, it can recover quickly from negative news. When it's vulnerable, it will recover slowly from negative news. Based on these and other measures, our ETF rotation strategy favors ETFs that are resilient avoids ETFs that are vulnerable.

The Decline and Recovery Sequence

After the Macro MRI begins the downleg of its cycle, its downward trend indicates that the long-term trend of stock prices is most likely to down.

There are two ways the Macro MRI ends its downleg and moves higher in a way that signals the beginning of a bull market and that makes it prudent to be more aggressive. The most common over the last 100+ years is for the Exceptional Macro to appear, which signals exceptionally high resilience and foreshadows a later shift in the Macro MRI to the upleg of its cycle. The less common way is for the Macro MRI to turn positive without the appearance of the Exceptional Macro, which happened in 1927 and 1993.

PO Box 996, Lynden, WA 98264, USA

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.