5. Response to Skeptics (transcript below)

- Our responses to skeptics of market timing

- What happens when you miss the ‘best days’ or ‘best weeks’ of the stock market

- How Focused 15 portfolios perform well in the face of these criticisms

8 minutes

For the first 20 years of my career in the institutional investment industry, I was 100% in the camp of asserting that asset class rotation (which can be considered a form of market timing) could not be done successfully over the long term. I believed that the narrow breadth of bets one typically placed in asset class rotation portfolios meant that one had to have an exceptionally high level of expertise and fantastic forecasts to get decent returns over time – and no one had a sufficiently high level of expertise.

Mine was not just a passing dismissal of market timing. No, I ran a group within Russell Investments to help investment managers improve their investment platforms and add value in ways that did not require asset class rotation and similar big bet, low-breadth investment strategies.

However, in the early 2000s, one of our clients asked us to look more objectively into the industry bias against market timing. I had experienced the major decline in Japan, and this was an opportunity to look into this issue more thoroughly and systematically. This research led to a conversion in my thinking.

Today, I am doing something that seems similar to what I thoroughly believed could not be done. Far from being based in genius, the Focused 15 Investing approach does not make forecasts about future economic or political events. Instead, we take advantage of the natural cycles of resilience – some people call it the market’s tone, sentiment, or climate – in the markets, making short-term (1 to 6 week) forecasts of market resilience. Very simply, we are buying low and selling high on these rhythmic and persistent resilience cycles.

But our approach is not a common one and you may hear advice telling you to stay fully invested in the stock market. The main reason given for why people should stay fully invested in the stock market is first, one can't accurately forecast the market's direction, and second, if you miss a few days, you'll miss the major gains in the stock market.

Below is a screenshot from a website called Visual Capitalist. The link is at the bottom of the page. The image covers the period from 2012 to 2018 and is titled “11 Calls for Market Crashes.” The organizations who are making these calls are reputable organizations: PIMCO, Society Generale, Guggenheim, Barron's. Although many people say you can't forecast the market direction, many people try, and many people get it wrong. The logic goes that if you can't forecast market direction, you shouldn't be making changes to your allocation to stocks.

The second point made about the stay fully invested advice is: If you miss the best days in the stock market, you'll miss out on most of the stock market's gains. If you google miss the 10 best days in the stock market, you get a number of articles that discuss that point. If we look through this list of headlines, they include an article from Putnam: “Time, Not Timing, is the Best Way to Capitalize on the Stock Market.” Fidelity says stay invested don't risk missing the market's best days. This view—that most of the gains that occur in the stock market take place on a few days, and you have to be in it to win it—is one of the key arguments.

I'd like to focus in on what the Motley Fool says about this (see image below). The headline is at the top: What Happens When You Miss the Best Days in the Stock Market. This is the screenshot from the Motley Fool, and it cites a cites a report from JP Morgan Asset Management, the 2019 retirement guide. It shows the impact pulling out of the stock market has on your portfolio, and looking back over the 20-year period from January 1999 to December 31 2018, it indicates that if you missed the top ten best days in the stock market, your overall return was cut in half.

That is a pretty compelling figure. But let's take a look at what those figures are. If one stayed fully invested in the stock market, in the S&P 500, the annualized return over that period was 5.62%. If you missed the ten best days, that return dropped down to 2.01% on an annualized basis, and if you missed the twenty best days of return, your annualized return was minus 33 basis points. This reinforces the idea that you have to be in it to win it.

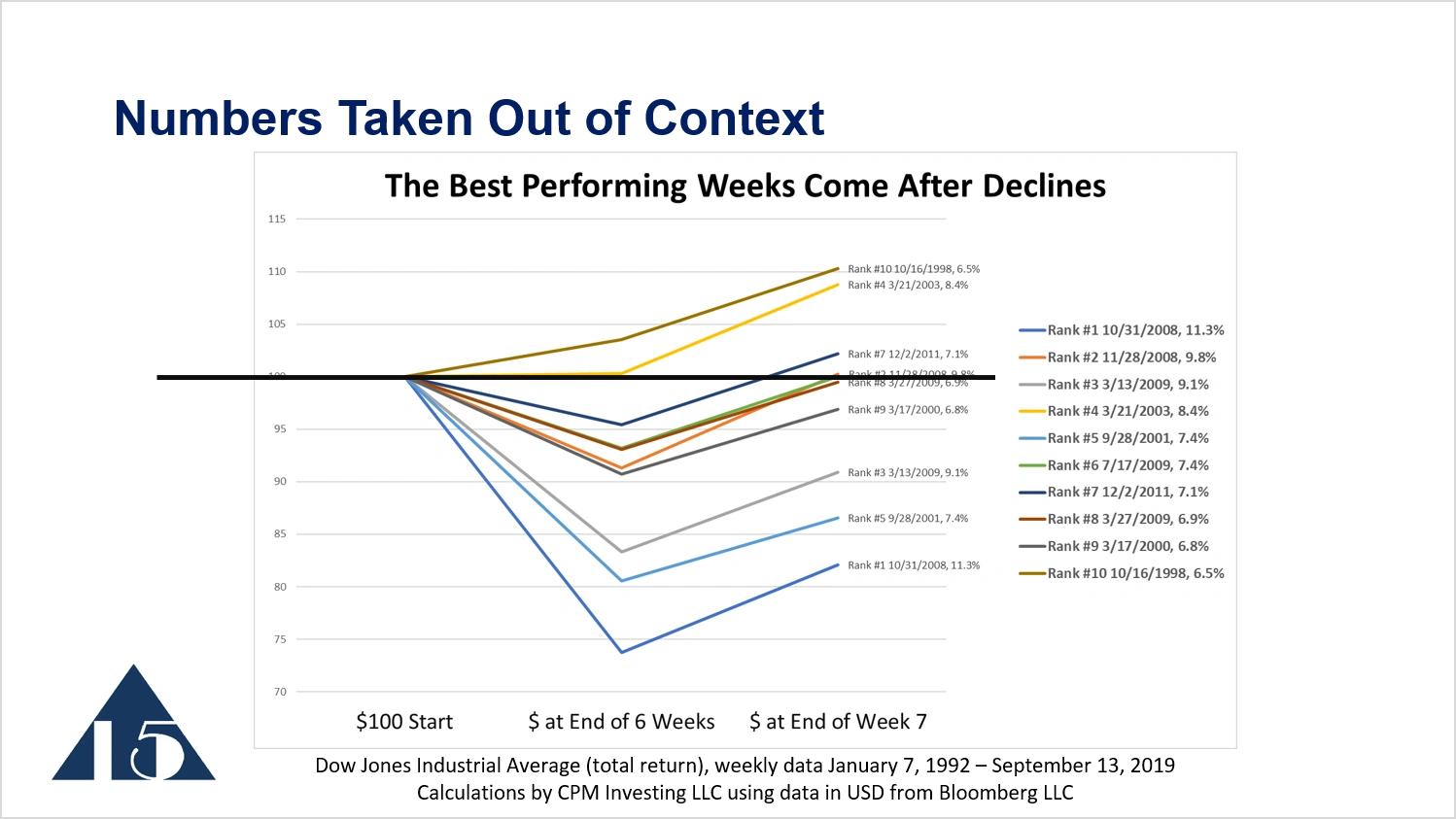

But let's take a closer look at some of those numbers and where those big returns take place. The image below shows the ten best performing weeks since 1992. This is from the Focused 15 database, and we calculate everything on a weekly basis, but the same patterns will hold true. If you look on the internet, you can find a similar kind of analysis done on the daily returns.

The number one best-performing week since 1992, was on 10/31/2008, which appears at Rank 1 above, and that return was 11.3%. The second best-performing week was a 9.8% return, the third 9.1%, and even the 10th best-performing week over that time period had a 6.5% return. These are big numbers. If you missed out on these numbers, the story goes that you will miss out on most of the returns of the stock market.

But these numbers are taken out of context. The image below shows what took place over the six weeks prior to the date given above.

Let's take a look at the best-performing week, which was October 31, 2008, with an 11.3% return. That 11.3% return indicates the return for the one week - a very high return. But over the six weeks prior that strong performing week had very low returns. In fact, the decline over the six-week period just prior to this stellar week, the market dropped by over 25%. The rebound of 11.3% is clearly good, but you would have been better off by missing both the 25% decline and 11% rebound.

If we look at a number of the other top-performing weeks, most of them are still underwater compared to where they were just six weeks prior. Over the seven-week period, the six weeks prior to the stellar return and the one week of stellar return, only three of weeks listed have a net gain for that seven-week period. Seven of them are equal with where they started seven weeks earlier or lower than where they started seven weeks earlier.

The key market characteristic behind these numbers is that stock prices have broad tops and narrow bottoms. The peak of the stock price takes place over a period of several weeks or even months, while the bottom is narrow.

There is usually just one day that is the lowest point, and then the price moves up sharply from there. If you measure return starting at that lowest day, you will get big numbers.

When stock prices then begin to make a broad top, they may move horizontally (little price change) for many weeks before they move down again to a narrow bottom.

The declines that were described in the earlier slide relating to not wanting to miss any of the recovery probably took place in a situation like this: where the declines were quite sharp, there was a low point, and then a sharp rebound. Yes, there's a dramatic increase in value compared to this low point, but it is still a point that is lower than the very top of the prior cycle and lower than many points along the beginning of the decline.

The Focused 15 approach is try to avoid these declines—try to get out of the stock market as the decline begins to unfold, with the goal of being out by point A. We then seek to get in at point B.

We have algorithms that help us make those allocation changes.

Below is a histogram of the returns of the Diamond Model Portfolio, which shows the distribution of weekly returns since July 18, 2014. The green dots indicate the number of weeks the Diamond portfolio had returns in the different buckets listed horizontally. Different magnitudes of weekly returns are along the horizontal axis in discrete buckets from “less than minus 12.5%” on the far left to “greater than 12.5% on the far right. The vertical black line indicates the zero point. The vertical axis is the number of weeks that fell into each bucket.

For example, the Diamond Model portfolio (indicated as Traded Portfolio), had over 100 weeks with returns in the range of 0% to 2.5%, which is shown by the highest green dot. The highest yellow dot shows the number of weekly returns for the upper risk mix, which is labelled as “Default” in the chart. Just over 80 of the weeks had returns from 0% to 2.5%.

The traded portfolio has a higher concentration of moderately positive weeks than the benchmark but lower concentrations of the negative weekly returns and of very high returning weeks (which are likely those occurring just after market prices hit bottom on a single day).

Our portfolios missed the biggest weekly gains (which likely occurred during the rebound off the very lowest point in stock prices), but we capture more of the gains that are moderate and small.

In terms of negative return weeks, the green dots are below the yellow dots on the far left, meaning we miss some of the largest weekly losses, but have a higher concentration of moderate losses – those close to the vertical black line. In summary, the distribution of weekly returns is shifted to the right and toward the middle. We miss the best-performing weeks and the worst-performing weeks, but we tend to do very well in the larger number of middle-performing weeks.

PO Box 996, Lynden, WA 98264, USA

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.